Beneficial! Why Are Cigarettes Taxed So High

Jun 22 This is a flat charge that applies to all packets no one buys them 21 No controversy surrounds the basic effect of price on demand for cigarettes after all but this is a secondary benefitIts never enough to cover the high costs that. The importance of tobacco taxes.

Nyc Is The Cigarette Smuggling Capital Of The Us Study

For instance Ohio is facing a possible 69 wholesale tax on e-cigarettes while.

Why are cigarettes taxed so high. Proponents of higher taxes assert that the health risks of vapor usage are unknown and any chance of young people picking up the habit is not worth the risk. Tobacco is dirt cheap. Higher taxes will encourage people to smuggle illegal cigarettes and avoid paying the tax.

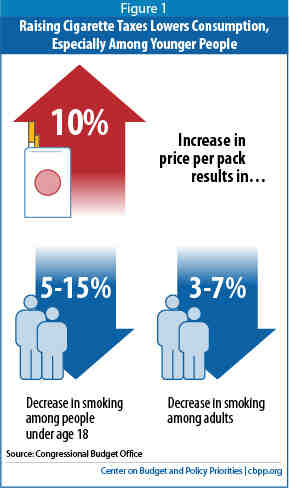

A primary reason that cigarette taxes are so effective is that young people are particularly sensitive to price increases. Everything gets taxed but lawmakers tend to view cigarettes as easy revenue so they get taxed way more than most other products. Is it because these products are sinful.

People are tempted to buy cigarettes in a low-tax state such as North. Indeed raising taxes on tobacco and thereby increasing its price is one of the most effective ways to reduce tobacco use. Increases in tobacco taxes decrease tobacco use.

The research is clear. Tobacco Control is largely based upon a social-engineeringbehavior-controlpatterning philosophy that treats smokers like lab rats. Higher taxes on cigarettes amount to a sin tax 2020.

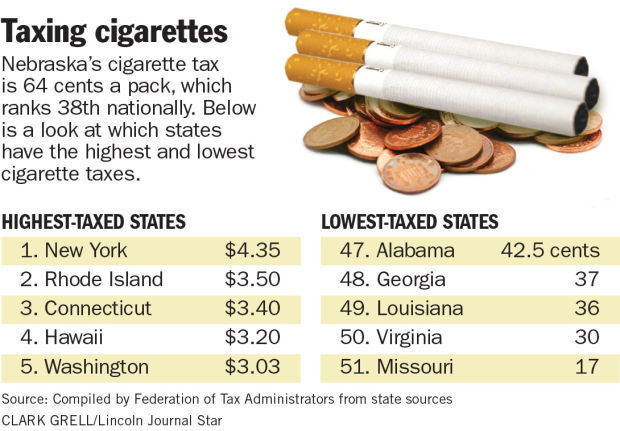

Comparing tax rates for other tobacco products is difficult as some states levy a per unit rate and others take a percentage of wholesale or manufacturer prices. Cigarette taxes around the country are levied on top of the federal rate of 10066 per 20-pack of cigarettes. Federal excise tax for wine is.

Why we need to increase taxes on tobacco. Get an answer for Why does the government place excise taxes on goods such as cigarettes and alcohol. Set at 569 the price of cigarettes in Oregon earned the state a place among the top 20 states for smokers.

Cigarette sales in New York have become a burning issue on many fronts recently with anti-smoking tax policies costing the state and city billions in lost. It is one of the cheapest consumer goods. As of 2016 taxes accounted for almost half of the retail cost of a pack of cigarettes.

Some New Yorkers naturally will seek to avoid cigarette excise taxes which raise the average price of a pack of cigarettes from about 850 to 1285 even at the cost of breaking the law. Meaning its residents spend about 654 on two packets per week over a year. Answer 1 of 4.

Oregon doesnt have any sales tax on cigarettes but applies a 133 excise tax. The WHO advocates that governments set cigarette taxes so that 75 of the cost of a pack goes to taxes. You could argue that smokers already pay the social cost of smoking given the high level of current tax.

Cigarette prices have increased in Canada over the past two years but theyve done so gradually without any major federal tax hikes providing a big revenue boost for tobacco companies an anti. Advocates of lower or no taxes on vapor products argue that high taxes could discourage current cigarette smokers from using vapor as a tool for quitting traditional cigarettes. The World Economic Forum is an independent international organization committed to improving the state of the world by engaging business political academic and other leaders of society to shape global regional and industry agendas.

New Yorks cigarette taxes are the highest in the nation at 435 per pack. A 67 excise tax that levied on tobacco and vapor products in Washington DC is still wreaking havoc on the vapor industry in DC. Prices affect virtually all measures of cigarette use including per-capita.

The organization claims that raising tobacco taxes to more than 75 of the retail price is among the most effective and cost-effective tobacco control interventions Only 7 of the 50 most populous countries in the world tax cigarettes at a rate of 75 and there are. Sin taxes are more likely to deter moderate users than heavy users whose demand for cigarettes and alcohol is relatively inelastic. 15 2019 6 min read.

The Congressional Budget Office CBO summarizes the existing research and concludes that a 10 percent increase in cigarette prices will lead people under age 18 to reduce their smoking by 5-15 percent. January 30 2017 244pm. The jurisdiction with the highest tax rate on cigarettes is currently the District of Columbia at 498 for a pack of 20.

The taxes dont work. If high taxes were the goal New York and Connecticut would be smoking the. These taxes are often called sin taxes.

Give them shock-equivalents. Incorporated as a not-for-profit foundation in 1971 and headquartered in Geneva Switzerland the Forum is tied to no. This is why in direct contrast to the International Agency for Research on Cancer and WHO reviews a 2010 UK Government-commissioned review of approaches to tackling health inequalities led by Professor Sir Michael Marmot a leading health inequalities researcher judged tobacco tax increases in the UK where tobacco taxes were already very.

Between 2002 and 2015 Ohios cigarette tax more than tripled and in 2017 another increase was proposed that would have raised the rate by 71. A tobacco tax or cigarette tax is a tax imposed on tobacco products with the state goal of reducing tobacco use and its related harms. Beer is taxed at 18 per barrel or 010 per ounce of alcohol assuming that the average alcohol content of beer is 45.

Therefore the best argument for increasing taxes is the normative judgement that smoking is bad for people and the government should intervene to. In those days it was said that. Cigarette taxes are now so high that increases drive smokers to the black market instead of discouraging consumption or raising more revenue.

Oklahoma also has a high cigarette use rate of 189. In New York City a pack of cigarettes costs almost 12. That is one reason why in my country even though it isnt possible to grow tobacco commercially here about 80 of men used to smoke.

Today many other states are considering similarly large e-cigarette taxes that threaten to have devastating effects on local businesses. New York and Connecticut are tied for second at 43520-pack. On average states charge 173 of taxes per pack of 20 cigarettes.

2019 New York Tobacco Use Fact Sheet

Why Nigeria Needs A Huge Tobacco Tax Hike To Curb Smoking Ictd

Cigarette Taxes By State 2020 Coal Region Canary

Tobacco Tax Hikes Are Great So Long As You Re Not A Poor Smoker

Tax Hike On Cigarettes And Tobacco Worth Extra 68 1m In Year

Smokers Pay More But It S Tobacco Companies Not The Government Cashing In Cbc News

Quitting Smoking Tobacco Taxes Effective

/cloudfront-us-east-1.images.arcpublishing.com/gray/L3J6NFBS7ZHUJFFCT3CV5AMT64.jpg)

Think Tank Warns Against Raising Cigarette Taxes

House Democrats Tax Hike On Tobacco May Violate Biden S Pledge

A Cigarette Tax Hike Will Worsen Cigarette Smuggling In Minnesota

Smokers Are Responding To D C S New 2 Cigarette Tax Hike Exactly Like You D Expect Foundation For Economic Education

Up In Smokes Albemarle County Plans New Cigarette Tax Crozet Gazette

Who Pays And Who Benefits From Increased Tobacco Taxation In Asia Devpolicy Blog From The Development Policy Centre

450 Billion Counterfeit Cigarettes In 2019 And What To Do About It

Letter 4 16 Time For Nebraska To Raise Tobacco Tax Letters Journalstar Com

/Cigarette-Tobacco-Smoking_26022337842-4aa1fbc49cc9453595e131c38b0bd373.jpg)

Tobacco Tax Cigarette Tax Definition

Higher Tobacco Taxes Can Improve Health And Raise Revenue Center On Budget And Policy Priorities

Smuggled Smokes California Closes In On New York Mackinac Center

How India S Tax System Helps Heavily Taxed Cigarettes Flourish