Agree! Why Are Overdraft Fees So High

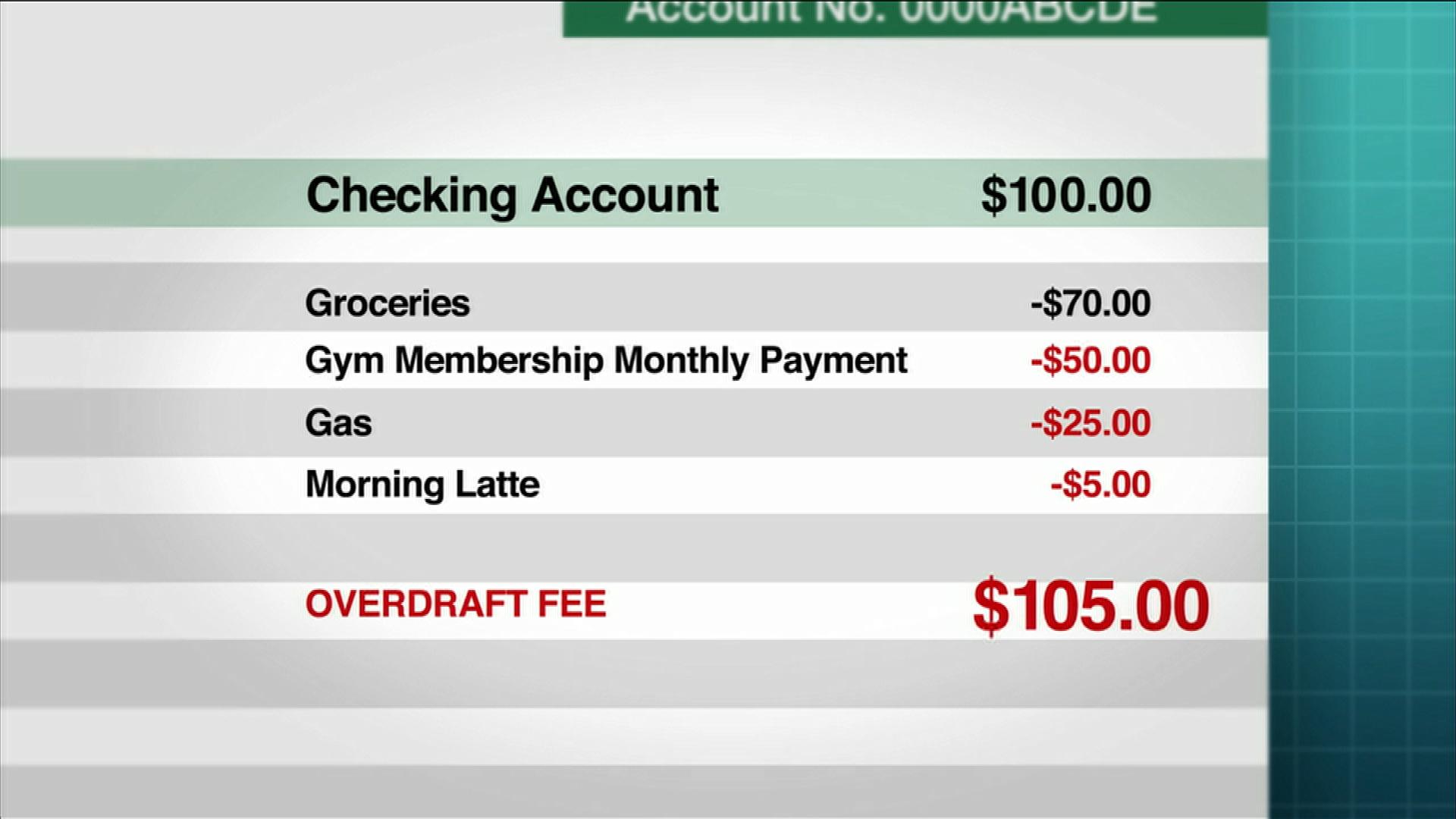

They incur overdraft fees because banks are not set up to meet their financial needs. An overdraft fee is what a bank charges you any time you withdraw more money from your account than what you have in it.

Tmobile Money Best Interest Rates Tmobile App

But this service isnt usually free.

Why are overdraft fees so high. Overview As banking becomes more automated and digital transactions continue to increase it may become more likely that a customer mistimes a deposit is hit with an unexpected bill or runs their debit card one too many times leading to a pricey NSF fee on their overdrawn account. The way a financial institution processes transactions can result in more overdraft fees for some customers. Overdraft fees can be a.

Rather than simply decline a transaction for insufficient funds at the point of sale a customer enrolled in their banks overdraft protection service will see the transaction approved. Rate this answer Because they are meant to be an expensive short term solution to raise funds. Why you should avoid overdraft fees.

This is different from linking your overdraft protection directly to a credit card which can be. As a result pretty much all banks started charging all overdraft users 40 per cent. To that end you should seek out a bank that has reasonable overdraft fees and policies so your business livelihood is never placed in jeopardy.

In 2014 the CFPB found that the majority of debit card overdraft fees are incurred on transactions of 24 or less. Why are NSF fees so high. It is difficult to argue from a position of fault whether real or implied.

If your banks overdraft fees are high you may find it less expensive to pay using a credit card. Also consumers repaid most overdrafts within three days. So its no surprise that they dont use banks.

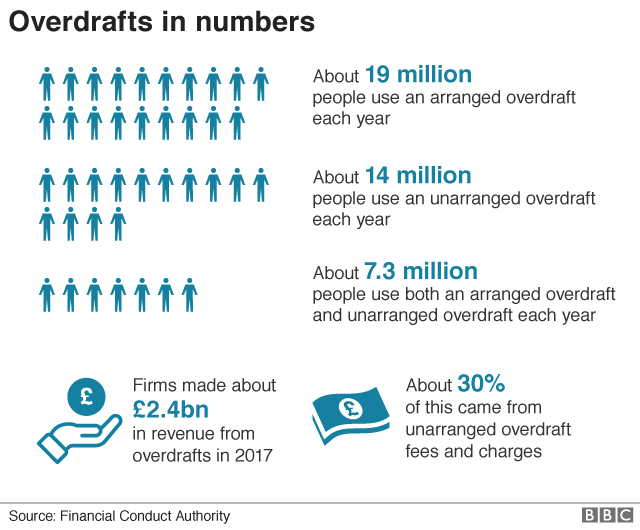

OVERDRAFT charges came under scrutiny in recent months. Many retail banks planned to raise some of their overdraft charges to nearly 40 percent before the FCA stepped in to halt the plans. The fee is linked to the risk the bank is undertaking by lending you that money how likely it is to get it back basically.

Lower income Americans have specific financial needs and banks dont meet them. In other words mortgage loans are collateralized 100 and the ban. So if you have three or four items returned you could be looking at well over 100 in fees.

An unarranged overdraft - sometimes called an unauthorised overdraft - is where you spend beyond the agreed amount youre allowed to borrow set. That is one reason why overdraft fees are so high. In fact the median overdraft fee most banks charge is 34 which can feel akin to being kicked while youre already down.

Why are overdraft fees so high. Overdraft facilities exist to help companies get cash quickly but they are not supposed to be used as a long term funding source. You can overdraw your bank account as often as you like as long as you deposit money into your account to bring it back into a credit positionyou know.

Reordering daily transactions from highest to lowest dollar amount can reduce the. Overdraft charges are normally made up of a fee often paid every day you spend in your unarranged overdraft and a bit of interest on the loan. So most have upped their authorised overdraft rates to get round this.

What is the number 1 cause of overdraft fees. Overdraft Fees Are Expensive. Most financial institutions including all of the top 10 banks charge multiple overdraft fees in one day.

Doing so will avoid overdraft fees but it could lead to bounced checks declined payments or transactions and non-sufficient fund fees. Here are just a few of the best banks with low-cost overdraft fees ranked in reverse order of their per-item overdraft fee highest to. Overdraft fees are one of the most common banking issues for American consumers.

Specifically customers of some banks allege that they have been the victims of excessive overdraft fees and that banks have used misrepresentation of account balances and reordering of credits. There can be other fees on top. Pros and Cons of Overdraft Protection.

Some people might ask why overdraft fees are so high and the answer is that the banks charge so much simply because they can. What is the number one cause of overdraft fees. You can expect to receive an overdraft fee if you conduct a debit transaction or withdrawal and dont have enough money in your account to cover the purchase.

High Fees Hurt With many overdraft protection plans your bank or credit union will pay your ATM withdrawals and debit card transactions that take your account balance below zero. The CFPB estimates that consumers pay 17 billion annually in overdraft and non-sufficient fund fees. An overdraft fee is a charge from your bank that occurs when you take more money out of your checking account than what is currently in there.

The FCA decided these charges were too high and too confusing so it banned treating people with unarranged overdrafts differently and it. Lloyds and Halifax even began charging. They rely on the shame factor to shut down complaints about high fees and it works very well.

As compared to mortgage loan rates the fees are low because the entire house is fully pledged to the bank and the loan amount is usually a fraction probably up to 85 of the value of the house at the time the loan was offered. Overdraft fees are pricey and add up quickly but it is not the end of the world if you get one.

Banks Reliance On Overdraft Fees Varies Widely Data Shows American Banker

Banks Asked To Explain 40 Overdraft Rates Bbc News

Not All Surprises Are Fun That S Why At T Mobile Money We Have No Account Overdraft Or Transfer Fees Because Your Mo New Skin Money Today Investment Advice

How To Get Overdraft Fees Waived With A Phone Script Updated 2020 Saving Money Frugal Money Saving Tips

The Real Cost Of Overdraft Fees American Banker

The 7 Best High Interest Checking Accounts To Get In 2018 Best For Avoiding Overdraft Fees Capital One 360 Checki Checking Account Capital One 360 Accounting

At Wealthfront We Believe That Everyone Deserves Access To Sophisticated Financial Advice Without The Hassle Or The Financial Advice Accounting Finance Saving

When You Get Caught Red Handed Notalwaysright Overdraft Work Bank Customer Account Caller Card Credit Funny True Stories Twitter Funny Funny Tweets

How To Get Overdraft Fees Waived With A Phone Script Updated 2021 Bank Fees Frugal Money Saving Tips

What S An Overdraft How To Get Overdraft Fees Waived Money Life Hacks Best Money Saving Tips Bank Fees

How To Avoid Overdraft Fees Saving Money Saving How To Find Out

What Is Overdraft Budgeting Budgeting Money Budgeting Tools

Chime Banking Made Awesome Banking Banking App Save My Money

Technology Politics Lead Banks To Rethink Overdraft Fees Indianapolis Business Journal

Overdraft Fees Cripple People Already Struggling Financially Povertyfinance Words The More You Know Truth

Transaction Reordering The Little Known Banking Practice That Could Cost You More Overdraft Fees Rachael Ray Show

Why Do Banks Charge Overdraft Fees Franklin D Azar Associates P C