Important! Why Is My Tax Refund Larger Than Expected

In an effort to combat fraud and identity theft the IRS limits the number of direct deposits into a single financial account or prepaid debit card to three refunds per year. Oh Heck Yes Sir.

Pin On What S Going On In America And The World Date

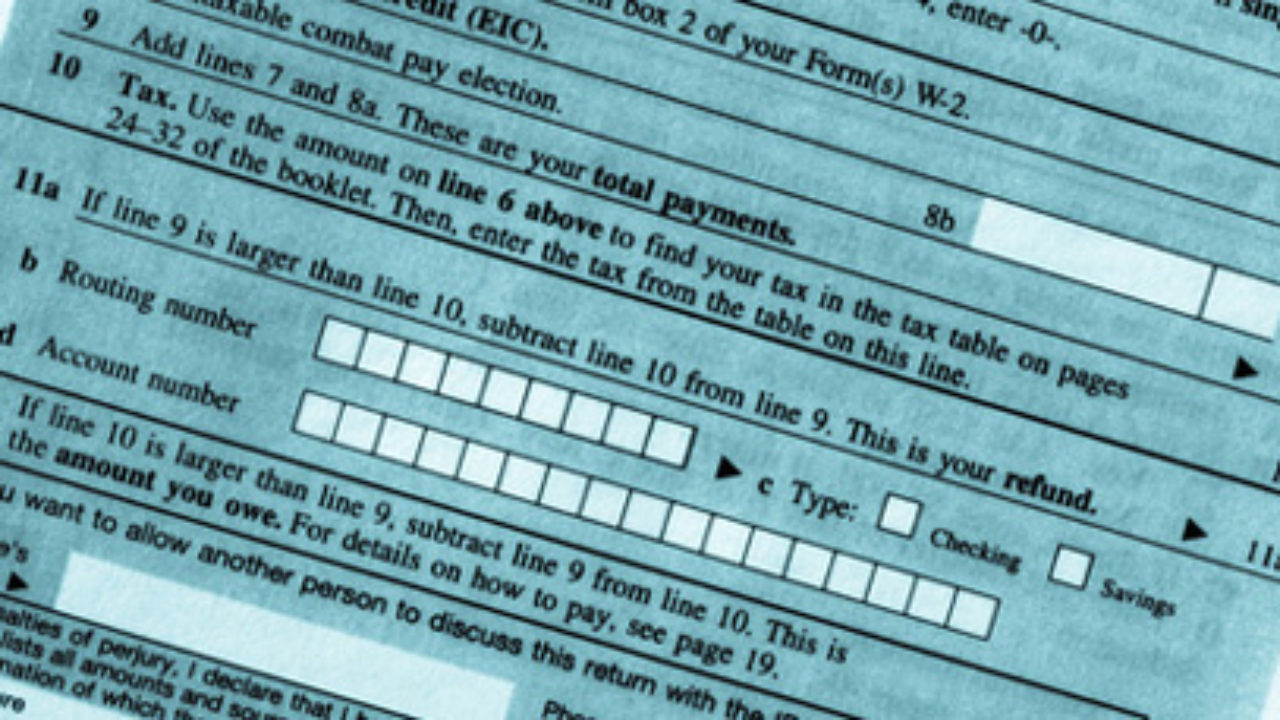

If your entries do not match the IRS records they will adjust the return and send you a notice.

Why is my tax refund larger than expected. Federal Tax Refund E-File Status Question. The IRS adjusted the return for the manual entries you made for the Recovery Rebate Credit. Instead be prepared to give it back.

I used Turbo Tax I just checked my account and was refunded 373. Why Your IRS Refund Might Be Even Bigger Than You Thought. The research conducted by Morgan Stanley reveals that Americans are withholding too much from their paychecks.

But if you get a larger than expected tax refund dont cash the check or use the money when it hits your account until you receive a notice explaining it. I tried visiting check my refund status and entered the amount of 3240 to look up along with SSN but when the refund status. The bank predicts that refunds in 2021 will be 26 greater in value than they were in 2020.

Everyone likes getting a tax refund. The IRS will reconcile filed returns with the first and second stimulus payments issued and the Recovery Rebate Credit claimed on your return before issuing refunds. When filing it showed a refund of close to 1000 less fed.

The extra 399 is just a weird number and I cant figure out why. Your offset amount the amount of your refund money they take The agency receiving the payment. My refund was more than expected.

Taxpayers who exceed this limit will receive a notice and a refund check instead which may take up to 10 weeks. President Joe Bidens 19 trillion American Rescue Plan includes benefits that work as. These potentially generous payments are from the waiving of federal tax on.

Refund amount more than I filed for. So I filed my taxes using TurboTax and the amount I received deposited to my bank account was 399 more than what showed on TurboTax. Of Revenue it said I would be getting a refund of 239.

If youre not due the higher amount then dont spend it. However if the IRS overpays you dont start making plans to take an extra vacation buy a new car or give your savings account an extra boost. Your IRS Refund Could Be Bigger Than Expected.

I had filed my return using turbo tax in March and the refund amount expected was 3240. The agency says it has reviewed more than 31 million returns since mid-May resulting in the 28 million account deposits or checks issued this week. The IRS says its identified 13 million taxpayers who may be eligible for the adjustment according to a news release.

Is this a mistake i will have to pay back. IR-2021-76 April 5 2021 As people across the country file their 2020 tax returns some are claiming the 2020 Recovery Rebate Credit RRC. The IRS is mailing letters to some taxpayers who claimed the 2020 credit and may be getting a different amount than they expected.

On my actual form I sent to the Oregon Dept. Ad Learn How to Track Your Federal Tax Refund and Find the Status of Your Direct Deposit. Has anyone received their 2020 tax refund that was higher than expected.

Just saw that IRS has refunded 4118 instead. Federal Tax Refund E-File Status Question. State than was deposited.

The notice will show all of these. If they take refund money to pay a debt youll get a notice from the BFS with information about why the refund from your tax return is less than expected. False refunds can be a result of fraudulent activity IRS error or in some cases underreporting on the part of the taxpayer maybe you neglected to report estimated tax payments you made during the year for example.

Finally received my Federal tax refund but it was more than it was supposed to be Posted by TIGERSby10 on 61920 at 1218 pm 0 7 So I filed my taxes about three months ago and long story short I had to mail my return instead of efile. Check For the Latest Updates and Resources Throughout The Tax Season. When I check the status of my refund on the OR DOR website using my SSN and original refund.

The work is slow-going. Because the coronavirus pandemic severely limited the ability of the IRS to process tax filings many refunds have been delayed and will be accompanied by a. You can use this free tax refund estimator to see how much your tax refund will be.

The next batch of refunds is expected to go out in mid-June. Sometimes the IRS does find mistakes in your calculations or entries and it will send you a. Tax refund larger than expected OR Taxes.

I just received my state tax refund.

Do I Need To File A Tax Return Forbes Advisor

Tax Refund Delay How Many Irs Tax Returns Remain Unprocessed As Com

Fillable Form 8829 Fillable Forms Form Pdf Templates

Fun Workouts Tax Refund Fitness

Faqs On Tax Returns And The Coronavirus

Here S The Average Irs Tax Refund Amount By State

Profile Of Home Buyers And Sellers Reasons To Buy Real Estate Buying Home Buying Arizona Realtor

Irs Payments Abound In July But Frustration Remains For Those Awaiting Tax Refunds

Ways To Receive Your Tax Refund H R Block

Bonus Time How Bonuses Are Taxed And Treated By The Irs The Turbotax Blog

Business Bank Accounts Look More Professional The Bank Account Can Be In The Name Of The B Cash Flow Statement Profit And Loss Statement Business Bank Account

Homepod Mini Vs Amazon S Latest Echo Speaker Which Is Best Idrop News Mini Small Speakers Pod House

How Many Child Tax Credit Payments Are Left Important Dates Parents Should Know Cnet

Irs Sends 2 8 Million Refunds Owed To Jobless Who Filed Early Returns

What To Do If Your Tax Return Is Flagged By The Irs

Irs Starts Sending Unemployment Benefits Tax Refunds To Millions Of Taxpayers Plus More Special Refunds Payments On The Way

Ways To Receive Your Tax Refund H R Block

Taxes 2021 Everything New Including Deadline Stimulus Payments And Unemployment Cnet