Important! Why Is My 529 Being Taxed

In addition to being taxed on the earnings youll take an additional 10 tax penalty on those earnings. Ad Flexible Affordable Tax-Advantaged College Savings Program.

What Can I Do With Unspent Money In A 529 Plan Law Offices Of Robert J Varak

Why is my 529 distribution being taxed keyword after analyzing the system lists the list of keywords related and the list of websites with related content in addition you can see which.

Why is my 529 being taxed. However the PATH Act gives you until February 16 2016 to. How to Take Tax-Free Qualified Withdrawals From a 529 Plan. There are two types of 529.

Learn Other Ways How Opening Up a Vanguard 529 Plan Can Help You Reach Your Savings Goal. But being taxed twice is something that thankfully only happens to a small percentage of the population. The excess distributions beyond the adjusted qualified expenses are the non-qualified distributions from which you will calculate the taxable portion.

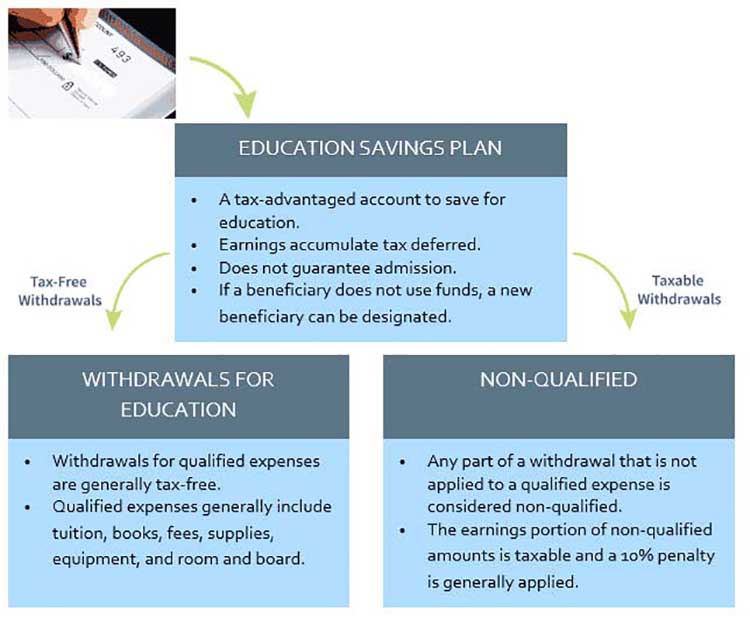

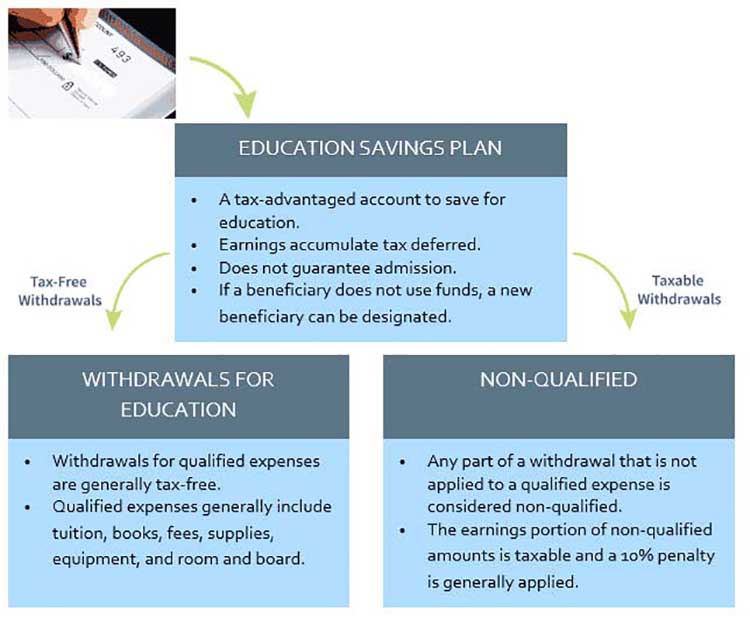

Withdrawals called distributions are not subject to federal income tax if the plan. Rowe Price College Savings Plan Can Help You Save For Education. 529 plans legally known as qualified tuition plans are sponsored by states state agencies or educational institutions and are authorized by Section 529 of the Internal Revenue Code.

You contribute money to specific mutual funds in the plan and you get a tax. Rowe Price College Savings Plan Can Help You Save For Education. A 529 plan is a tax-advantaged savings plan designed to encourage saving for future education costs.

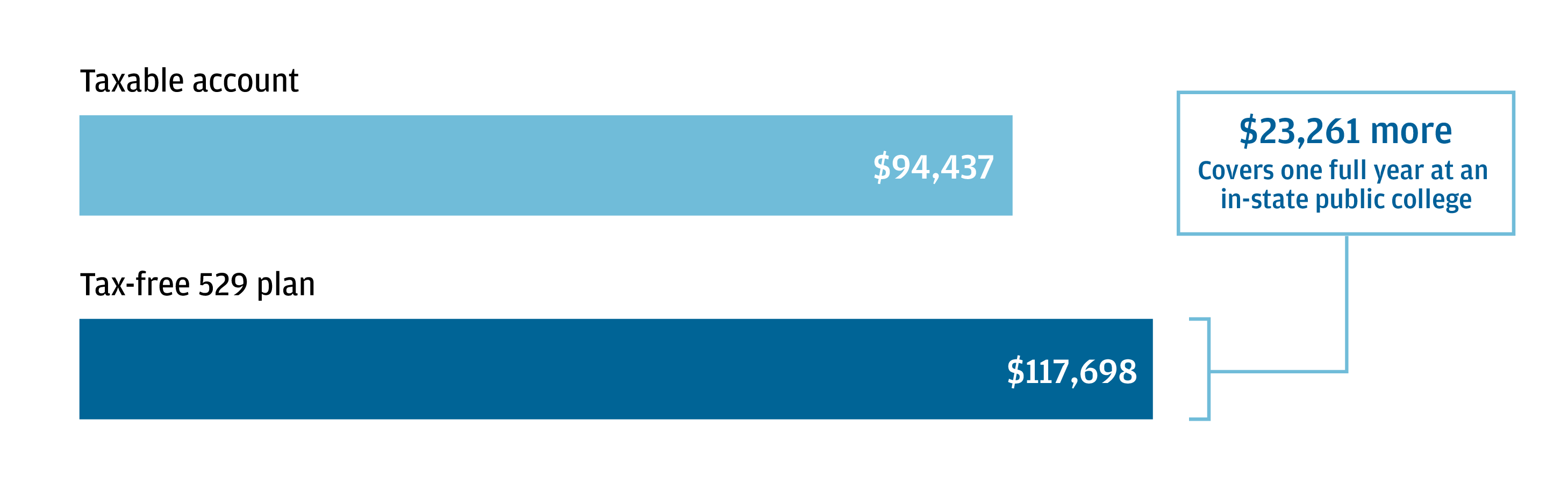

The earnings generated in a 529 plan are not subject to federal income taxes allowing the investments to grow without being depleted annually by taxes. Rowe Price 529 College Savings Plan For As Little As 50 Per Month. Why would I want one.

Rowe Price 529 College Savings Plan For As Little As 50 Per Month. 529 plan distributions used to pay for non-qualified expenses are subject to income tax and a 10 penalty on the earnings portion of the withdrawal. 529 plans save taxpayers billions of dollars on their income taxes.

Ad Open A T. See Why Were Ranked Among The Top College Savings Choices Nationwide. Because the tax benefits put money in.

Withdrawals from a 529 plan are tax-free to the extent your child or other account beneficiary incurs qualified higher education expenses QHEE during the year. Ad A 529 Plan Can Help You Pay for Qualified Education Costs While Reducing Taxes. A 529 plan allows you to save for college or higher education while receiving some type of tax benefit.

The credit adjustment will now leave you short and a portion of the 529 earnings will be taxed and penalized. You cannot count the same tuition money for the tuition credit that gets him an exclusion from the taxability of the earnings interest on the 529 plan. In a nutshell.

You do not report the distributions as income. A 529 college savings plan is a tax-advantaged investment account similar to an IRA or a 401k. However if you accidentally use the funds on ineligible expenses or make a withdrawal the 529 distribution may be subject to a penalty fee.

Whats more the investment earnings in your account are not reportable until the year they are withdrawn. Unlike an IRA contributions to a 529 plan are not deductible and therefore do not have to be reported on federal income tax returns. Earnings from 529 plans are not subject to federal tax and generally not subject to.

Note that 529 plan. Since the credit is more. A 529 education savings plan is a qualified tuition program that offers tax benefits to investors.

Ad Open A T.

5 Steps For Picking The Best 529 Plan In Any State Best 529 Plans 529 Plan How To Plan

The True Power Behind A College Savings 529 Plan Is That Your Money Will Grow Faster Than Money In Compa Saving For College Saving App 529 College Savings Plan

Funds In 529 Plans Grow Tax Free And Can Be Withdrawn Tax Free If They Re Spent On Eligible Education Expense Saving For College Federal Student Loans 529 Plan

Why A 529 College Savings Plan T Rowe Price

529 Plan Tax Benefits J P Morgan Asset Management

What You Can Withdraw Without Penalties And Taxes Include Tuition And Related Fees Room And Boar College Finance Financial Aid For College Saving For College

The Intersection Of Design Motherhood Top Lifestyle Blog Design Mom Saving For College College Savings Plans College Money

F709 Generic3 Worksheet Template Printable Worksheets Profit And Loss Statement

The Why What And How Of Filing Your Own Taxes From A Cpa Tax Tax Time Filing Taxes

Astute Savers Don T Just Use 529 Plans For College Savings

529 Plan What You Need To Know Understanding Tax Benefits Sbnri

Tax Deferral Can Have A Dramatic Affect On The Growth Of An Investment With A State Sponsore 529 College Savings Plan Saving For College College Savings Plans

How A 529 Plan Works State Farm

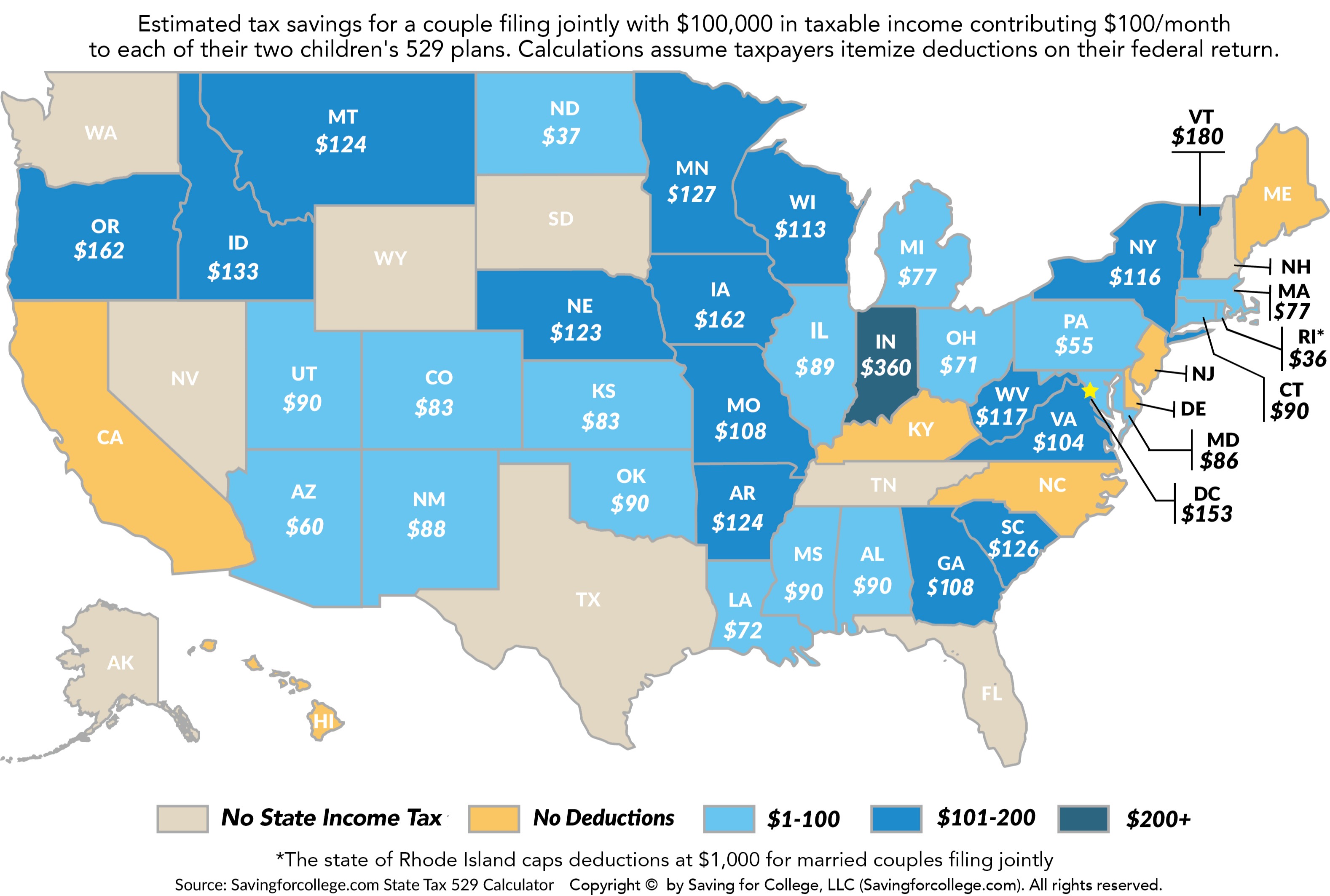

How Much Is Your State S 529 Plan Tax Deduction Really Worth

529 Plans Which States Reward College Savers Adviser Investments

Why It Pays To Open A 529 Account Ascensus

529 Plan Vs Roth Ira How To Save For College The Dough Roller Saving For College Roth Ira 529 Plan

529 Plan Tax Benefits And Advantages Learning Quest

Does Your State Offer A 529 Plan Contribution Tax Deduction How To Plan Budgeting 529 Plan