OH MY GOD! Why Would My Pension Decrease

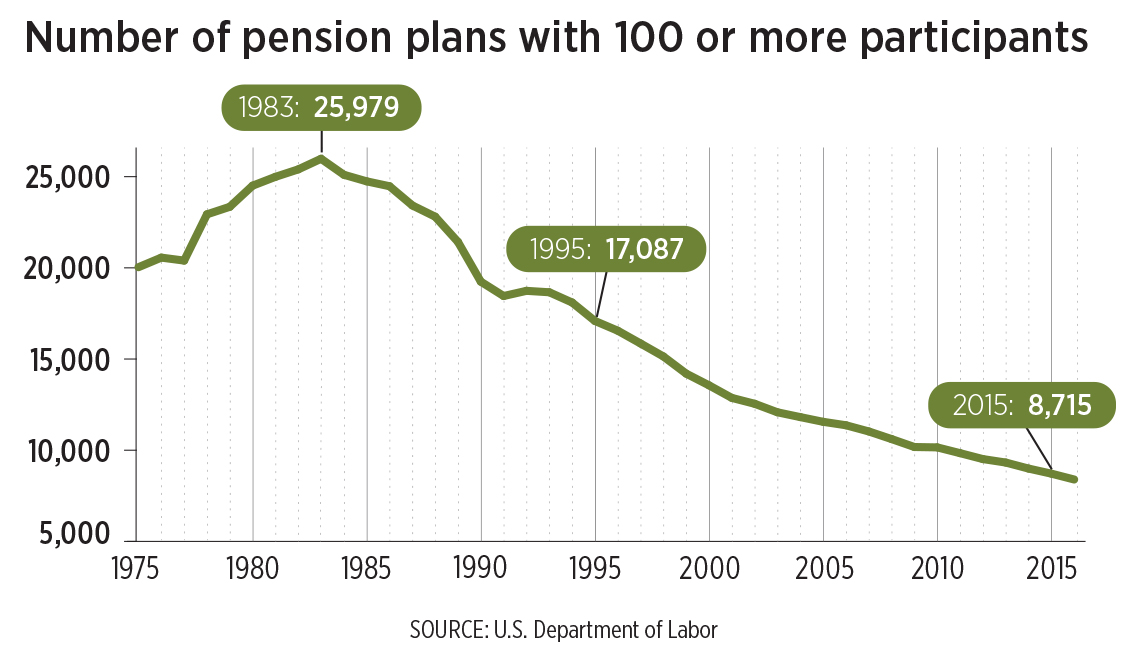

Generally pension funds invest about 65 of their assets in stock and spread the rest among bonds real estate and other investments. Why does the pension amount decrease over time.

How Much Is The Age Pension Rates How It Works Canstar

GIS is a supplementary benefits that paid on top of the OAS benefit.

Why would my pension decrease. The pension income test is for people who get any of the following. Thats why the Government moved to reduce the minimum drawdown as one of the measures in its COVID-19 stimulus package. Single homeowners can have up to 588250 in assets an increase of 2500 to be eligible for a pension payment while single non-homeowners can have 804750 an increase of 4500.

So when the stock market takes a dive it cuts into the amount available to pay pension benefits. Your income includes money from. Depending on the fund performance your pension can go down as well as up.

However if you are single you would need to have assessable assets over 250000 for your Age Pension to. That said pension funds overall went into this year in pretty good shape. Ad Have Someone on Your Side.

Pensions have income and asset limits. When the pensioners noticed their OAS benefit payment reduced when checking their bank statement it was most likely due to the amount paid under GIS was either changed or stopped. However before reducing your assets it is important to bear in mind whether your remaining savings can support any shortfall in your retirement income needs as any increased pension amount may.

You can reduce your pension if you wish and your administrator may well. When inputting the pension information I enter the degree of inflation index amount equal to the inflation number entered in. If your pension is fully adjusted fo.

Get What You are Entitled to. For a couple to qualify for the full Age Pension your combined income must be below 320 per fortnight approximately 8320 per year but you can still be eligible for a part Age Pension if you earn less than 323720 per fortnight approximately 84167 per year. The federal govt pension includes a COLA just like social security.

You need to consider what youve earned or lost on your investment overall in relation to what youve paid in rather than over a shorter period. Since its under OAS program both benefits were paid under one payment. This was due to many retirees losing a significant portion of their super account balance as sharemarkets have plunged due to the coronavirus crisis.

The asset value limit is the amount of assets a person can own before their pension or payment will reduce from the maximum rate under the assets test. To change or correct your legal name well need both of these. Return to Question Forum.

To work out how much income your financial assets produce we use deeming. Ad Have Someone on Your Side. Once your assets reach the lower threshold your pension starts reducing by 3 per fortnight single or couple combined for every 1000 worth of assets you own above the threshold.

This includes financial assets such as superannuation. Who income tests are for. There are a number of strategies that may be used to reduce asset levels which may result in qualifying for a part pension or increasing the current pension amount received.

A couple who own their home and with assets in excess of 823000 stand to lose over 12500 in pension payments each year. On 22 March 2020 the federal government announced that the minimum pension drawdown rates would be temporarily halve for the 2019-20 and 2020-21 financial year. The disqualifying asset thresholds will also increase on 1 July which will increase the number of Australians that may become eligible to receive a pension payment.

You can find your state or territory Births deaths and marriage. Your pension is a long-term investment that is linked to the stock market also known as equity investment and so there will be short term fluctuations in fund value. Because your pension is cut at a faster rate for having more assets it means the upper limit to receive a part-pension and the all-important pensioner concession card will decrease to 823000 for homeowner couples and 547000 for single people.

Submitted by Tom Formhals on Wed 01062016 - 1342. My pension came with a guaranteed minimum pension GMP of around 3900 and I was told that taking this into account I would have 112500 left after taking my 25 per cent lump sum with which. Currently the asset value limit for a single service pension homeowner is 270500.

Putting that differently if youre already assessed under the assets test every 1000 in extra assets will reduce your pension by 3 per fortnight or 78 per annum. There are a number of reasons why Centrelink could reduce your pension income including changes to age pension asset limits and the taper rate which is the rate by which your pension reduces for every 1000 of assets over the limit that Centrelink believes you hold. If your pension does not keep up with inflation its real value its value in todays dollars will decline through time.

If youre over these limits you get a lower pension. Its important to note that you can earn up to 300 per person per fortnight from working and this. An original document issued by a state or territory Births Deaths and Marriages registry.

These tests measure your income how much money you get and the value of your assets what you own for example any investment properties. The changes to the Age Pension asset thresholds and associated taper rate which will happen on 1 January 2017 may result in a reduction to your Age Pension payment. This loss to inflation will show up in the report as a declining annual pension amount.

If your income or assets are above certain limits your pension payment will be reduced or you may not be eligible at all. Your consent to verify the document. You need to bring your document to a service centre so we can update our records.

If you are a homeowner your asset value limit is lower than someone who does not own their residence. Get What You are Entitled to.

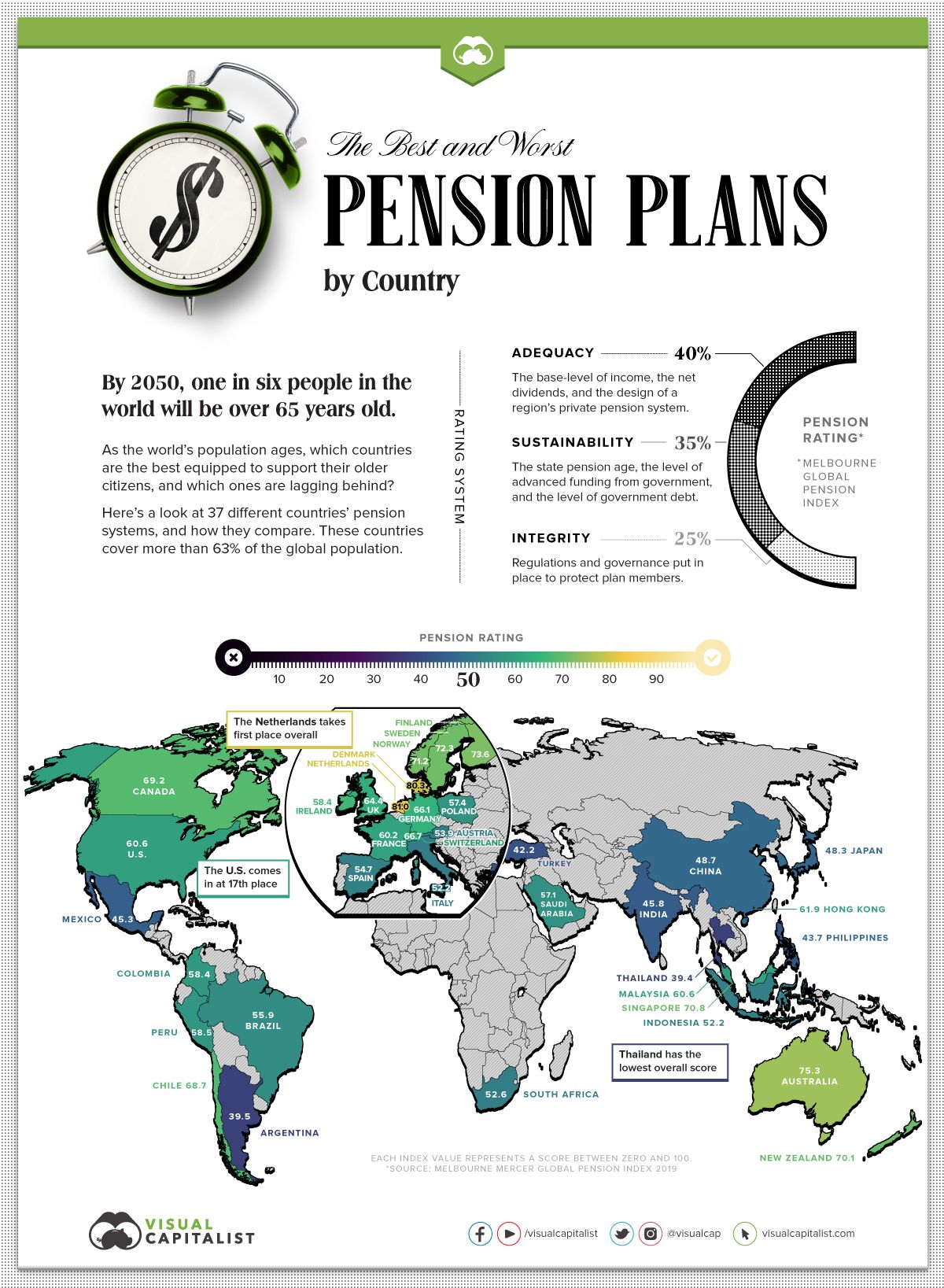

Ranked Countries With The Best And Worst Pension Plans

Pension Deficits Should You Be Concerned And What Are Your Options Experts For Expats

How Does Age Pension Work In Australia Savings Com Au

If I Retire And Begin Receiving My Pension Can I Still Work Findlaw

Money And Life Defined Benefit Pension Essentials Cpd Quiz

Should You Overpay Your Mortgage Or Pension Fund Loantube

Age Pension Assets Test Limits September 2021 To March 2022

Should I Cash In My Pension Times Money Mentor

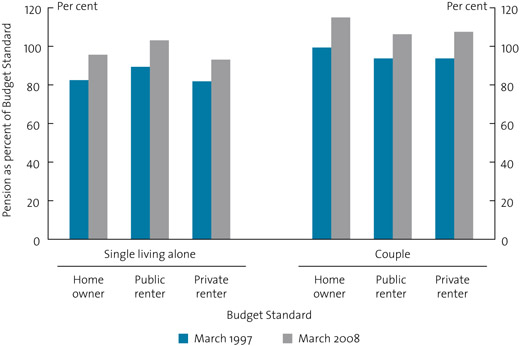

Pension Review Background Paper Department Of Social Services Australian Government

How Much Is The Age Pension Rates How It Works Canstar

Age Pension Income Test Limits September 2021 To March 2022

What To Do If Your Pension Is Frozen

Will Disability Benefits Lower My Pension Disability Benefits Help

Minimum Pension Payments For 2020 21 And 2021 22 Including Calculator

Age Pension Changes What They Mean For You National Seniors Australia

How Much Can You Save Without Affecting Your Age Pension Payments Starts At 60

How Does Inflation Affect Pensions Pensionbee