Perfect! Why Are Oregon Taxes So High

This is grossly unfair and discourages the traditional way of American life that is work hard own a home and be a stable member of society. Tax Freedom Day is the day when taxpayers as a whole earned.

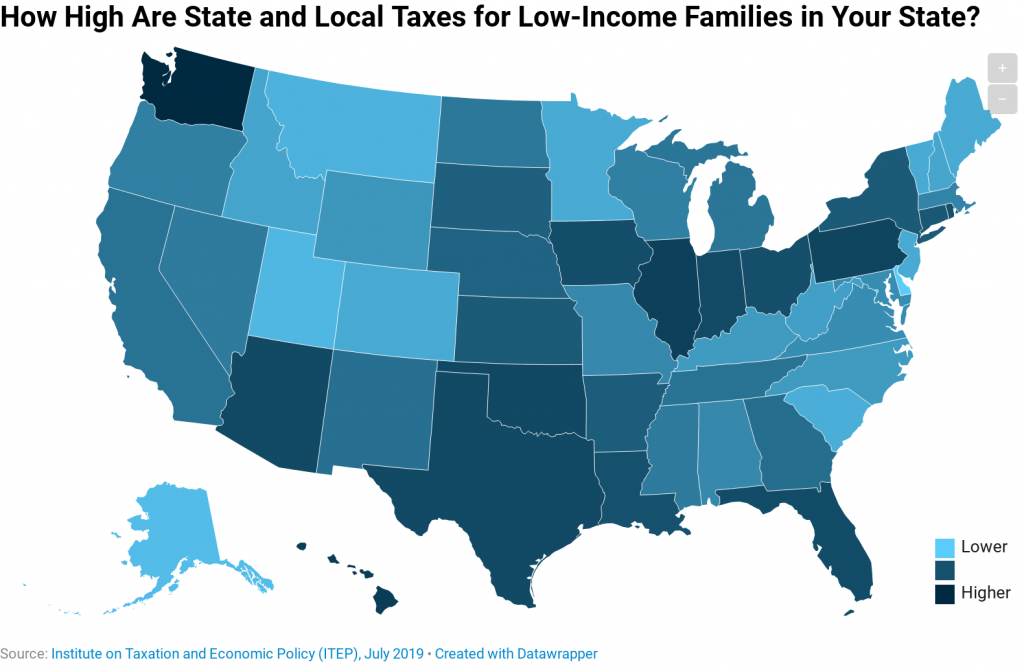

Which States Have The Highest Tax Rates For Low Income People Itep

Census Bureau data reveals that Oregon is the 17th biggest spending state in the nation per capita.

Why are oregon taxes so high. They lists just four states nationally as having lower per capita incomes than Idaho. That indeed appears to be high. So people in Idaho are paying more of their income in state and local taxes than.

How does Oregon rank. Oregon isnt part of ifta. Indeed the system was incorrect.

The reason Oregon income taxes are so high is because there is no sales tax. Property taxes tend be lower than most places too thanks for measure 5. Combined with local sales taxes the rate can reach as high as 1025 in some California cities although the average is 866 as of 2020.

So the actual cost of fuel is 339 - 076 263 OR 026 more than in Oregon. I cant see this making it desirable for any companies to start or move here when in contrast nearby Washington State is 0 Personal and 18 Corporate. Why are the personal income and corporate taxes so high in Oregon.

The founder of Tax Fairness Oregon a tax. As for the why its real simple states have the right to decide these things they decided against it. Failure to pay property taxes may result in a lien on the property and utlimately in a tax sale to recoup the delinquent taxes.

Now if that was the right decision is a separate arguement. Follow me on Twitter or LinkedIn. The first step towards understanding Oregons tax code is knowing the basics.

Prices soared so high that in January home builders asked President Joe Biden for help as they struggled with lumber costs and delivery times. Generally taxes in Oregon overall rate right in the middle compared to other states but we do have one of the highest income taxes thanks mostly to the fact that we dont have a sales tax. That was when Oregon instituted a progressive income tax as a way to help equalize taxes among residents.

Oregonians will have to pay 18 to 110 more per year to register their vehicles come Jan. According to the Tax Foundation people in only two states pay less money per capita in state and local taxes than Idahoans. Federally Tax Freedom Day is three days later this year and falls on April 21st.

Today Oregons 99 percent top rate is behind only Californias. So essentially you are paying 2500 in employer payroll taxes the other 3000 is withheld and can be claimed back by employees when filing for tax returns. Californias state level sales tax rate remains the highest in the nation as of 2018 at 725.

Its nearly 10 personal and almost as high for corporate. 1 as the state implements a new tiered fee structure with higher rates for. I carefully checked the info entered from my W-2 and from our estimated payments.

Compared to other taxes collection rates for the property tax are relatively high ranging often from 92 to 98 percent collection ratios. All the figures were correct. If you work for a living and own a home then all of the people that do not work or own a home live off of you back.

The National Tax Foundation rates Oregon as the 16th highest tax state in the nation. Oregons high taxes matches with its big spending ways. I did not take the refund but had it applied to my estimated tax payments.

Everyone would be well-advised to plan accordingly. So youre better off fueling in Oregon and sending IFTA a couple bucks than throwing a fiddy out the window filling in the communist state. Then using the tax tables I figured what my tax should have been.

In California for example a gram of legal cannabis averages 3090 making it up to 545 costlier than street cannabis. Tax Foundation policy analyst Jared Walczak says thats due to the comparative size of the economy. Below we have highlighted a number of tax rates ranks and measures detailing Oregons income tax business tax sales tax and property tax systems.

California Sales Tax. The year was 1929. And this is actually a decrease from what it once was75 until Proposition 30 expired.

My son in law who is a tax attorney verified all the information as correct. Of course it also provided the state with a massive windfall. A family with two kids who got 3400 in stimulus money would owe 298 in Oregon taxes.

Now this wont apply to you if you make too little to pay federal taxes or. Each states tax code is a multifaceted system with many moving parts and Oregon is no exception. In Nevada a gram of legal cannabis averages 2694 making it.

So gasoline prices are indeed high and destined to go higher for a variety of reasons. Out of 8000 the employer taxes amount to 315 difference between 8000 and 10500.

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

States With Highest And Lowest Sales Tax Rates

Low Tax States Are Often High Tax For The Poor Itep

6 Things To Keep In Mind About Oregon Taxes Oregon Center For Public Policy

The Cost Of Living In Oregon Smartasset Oregon Living Cost Of Living Oregon

The States With The Highest Capital Gains Tax Rates The Motley Fool

Mapsontheweb Infographic Map Map Sales Tax

Why Do Some States Feast On Federal Spending Not Others Tax Foundation

How Idaho S Taxes Compare To Other States In The Region Boise State Public Radio

Oregon S Capital Gains Tax Is Too High Oregonlive Com

Why Are Minnesotans So Overtaxed

4 Ways To Reduce High State Income Taxes Arnold Mote Wealth Management

Mobile Web In India Taxes Humor Sales Tax Tax Day

Pass Through Income Tax Loophole Favors The Well Off While Disadvantaging Workers Oregon Center For Public Policy

The States Where People Are Burdened With The Highest Taxes Zippia

2021 Portland Tax Changes Bluestone Hockley Portland Property Management

What High School Students Need Now Internal Revenue Service Understanding Taxes Understanding Education Standards Lesson Plans

Pass Through Income Tax Loophole Favors The Well Off While Disadvantaging Workers Oregon Center For Public Policy